Navigate Your Financial Resources with Expert Loan Service Assistance

Navigate Your Financial Resources with Expert Loan Service Assistance

Blog Article

Pick From a Range of Funding Providers for Personalized Financial Aid

When it comes to seeking monetary assistance, the variety of car loan solutions available can be frustrating yet essential in safeguarding customized assistance. By exploring these diverse loan services, people can unlock chances for tailored economic support that line up with their goals and circumstances.

Lending Choices for Financial Debt Loan Consolidation

Financial obligation combination presents a possibility for people to simplify their financial commitments right into a solitary workable payment strategy. When taking into consideration lending alternatives for financial obligation consolidation, people have numerous avenues to discover. One typical option is an individual car loan, which enables debtors to incorporate multiple debts into one lending with a taken care of regular monthly repayment and passion price. Personal fundings are unsecured, implying they do not call for security, making them accessible to a wide variety of customers.

One more option is a home equity funding or a home equity line of credit rating (HELOC), which makes use of the debtor's home as security. These loans usually have lower passion rates contrasted to personal car loans however featured the danger of shedding the home if repayments are not made. Equilibrium transfer bank card are likewise a prominent option for financial obligation combination, providing an initial period with low or 0% rate of interest on moved balances. However, it is very important to very carefully think about the terms and charges associated with each alternative prior to picking one of the most ideal car loan for financial obligation loan consolidation.

Personal Car Loans for Huge Acquisitions

Suggesting on financial choices for substantial purchases often entails taking into consideration the alternative of making use of individual car loans. Financial Assistant (mca loan companies). When encountering substantial expenditures such as buying a new lorry, moneying a home restoration task, or covering unforeseen clinical costs, individual finances can give the required financial backing. Personal financings for huge acquisitions supply people the adaptability to obtain a specific quantity of cash and repay it in fixed installments over an established period, generally ranging from one to seven years

One of the key advantages of personal finances for significant procurements is the capability to access a swelling amount of cash upfront, allowing individuals to make the desired purchase quickly. Additionally, individual lendings frequently feature competitive rates of interest based on the debtor's creditworthiness, making them an economical funding option for those with good credit history. Before choosing for a personal loan for a big purchase, it is vital to assess the terms and conditions offered by different lending institutions to secure the most desirable bargain that aligns with your economic objectives and payment abilities.

Reserve and Payday Loans

When encountering an economic emergency, individuals should check out different choices such as discussing layaway plan with financial institutions, seeking support from regional charities or government programs, or loaning from loved ones prior to considering payday advance loan. Developing a reserve with time can likewise help reduce the requirement for high-cost loaning in the future.

Specialized Finances for Particular Demands

When looking for monetary aid customized to special conditions, people might explore specific loan options designed to deal with certain needs successfully (Loan Service). Trainee loans supply details terms and benefits for educational objectives, assisting students finance their researches and related costs without overwhelming monetary problem.

In addition, home improvement fundings are created for property owners looking to update their residential or commercial properties, providing practical settlement plans and competitive rate of interest for renovating projects. Furthermore, little organization car loans cater to entrepreneurs seeking capital to begin or expand their endeavors, with specialized terms that line up with the distinct demands of service operations. By checking out these specialized car loan options, people can discover tailored economic options that meet their particular demands, offering them with the required assistance to attain their goals effectively.

Online Lenders for Quick Approval

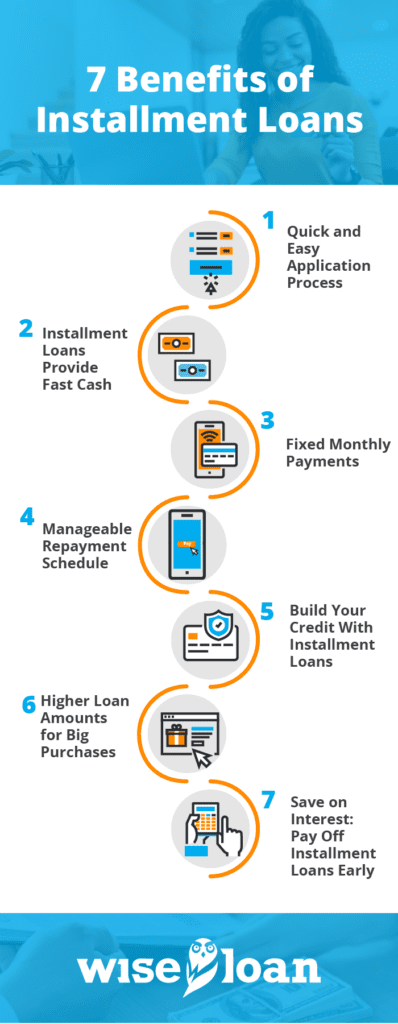

For expedited financing authorization procedures, individuals can transform to online lending institutions who offer swift and practical monetary remedies. On the internet lenders have actually transformed the borrowing experience by enhancing the application procedure and supplying fast approvals, often within minutes. These lending institutions usually supply a large range of lending alternatives, consisting of personal loans, payday advance, installment finances, and credit lines, dealing with diverse monetary requirements.

One of the crucial benefits of on the internet lenders is the rate at which they can process car loan applications. By leveraging modern technology, these lending institutions can analyze an individual's credit reliability immediately and make funding choices rapidly. This effectiveness is especially useful for those that require prompt access to funds for emergency situations or time-sensitive costs.

In addition, on the internet lenders commonly have much less strict eligibility criteria contrasted to conventional monetary institutions, making it easier for people with differing credit history profiles to secure a loan. This accessibility, combined with the quick approval procedure, makes online lending institutions a preferred selection for several looking for fast and easy monetary assistance.

Conclusion

To conclude, people have a range of finance alternatives available to address their financial requirements. From financial obligation combination to emergency funds and specific lendings, there are solutions tailored to particular situations. On-line lenders additionally offer quick i thought about this approval for those in requirement of instant monetary support. It is vital for people to thoroughly consider their options and select the loan solution that finest fits their demands.

Report this page